Review Categories

- Home Addition Cost Guide

- Building A House Cost Guide

- Modular Homes Cost Guide

- Concrete Crack Repair Guide

- Solar Panel Installation Cost Guide

- Attic Insulation Cost Guide

- Shiplap Wall and Siding Cost Guide

- Crown Molding: Installing, Cost, Tips & Ideas

- Retaining Wall Cost Guide

- Plaster Walls Cost Guide

- Rewiring House Cost Guide

- Recessed Lighting: Installation & Cost Guide

- Dining Room Lighting Cost Guide

- Home Backup Generator Cost and Installation Guide

- Fireplace Installation Cost Guide

- Fireplace Cleaning Cost Guide

- Wall Paneling Cost Guide

- Cinder Block Cost Guide

- Fiber Cement Siding Cost Guide

- Vinyl Siding Cost Guide

- Overall Basement Remodeling Cost Guide

- Basement Waterproofing Cost Guide

- Basement Flooring Cost Guide

- Insulating Basement Walls Cost Guide

- Basement Staircase Installation Cost Guide

- Bathroom Remodeling Cost Guide

- Bathroom Painting Cost Guide

- Bathtub Installation Cost Guide

- Frameless Showers Cost Guide

- Hot Tub Installation Cost Guide

- Stand Alone Tubs: Cost and Installation Tips

- Pedestal Sink Installation & Cost Guide

- Bathtub Refinishing Cost Guide

- Bath Fitters Cost Guide

- Tub Reglazing Cost Guide

- Bedroom Remodeling Cost Guide

- Room Painting Cost Guide

- Furniture Paint DIY Tips & Cost Guide

- Furniture Cleaning Cost Guide

- New Roof, Roof Replacement & Metal Roof Cost Guide

- Roof Painting Cost Gude

- Popcorn Ceiling Removal Cost Guide

- Attic Fan Installation Cost Guide

- Attic Ladder Installation & Cost Guide

- Lead Paint Removal Cost Guide

- Acoustic Ceiling Tiles Cost Guide

- Vaulted Ceiling Cost Guide

- Asbestos Removal Cost Guide

- Patio Lights Cost Guide

- Awning Installation Cost Guide

- Refacing & Painting Kitchen Cabinets Cost Guide

- Laminate Countertops Cost Guide

- Formica Countertops Cost Guide

- Quartz VS Granite Countertops Cost Guide

- Small Kitchen Island Cost Guide

- Foundation Repair Cost Guide

- Entry Door Installation Cost Guide

- New Furnace Cost Guide

- Laminate Flooring Installation Cost Guide

- Linoleum Flooring Cost Guide

- Hardwood Floor Refinishing Cost Guide

- Parquet Flooring Cost Guide

- Bamboo Flooring Cost Guide

- Vinyl Plank Flooring Cost & Installation Guide

- Marble Flooring Cost Guide

- Stained Concrete Floors Guide

- Tile That Looks Like Wood Cost Guide

- Garage Flooring Cost Guide

- Rubber Flooring Cost Guide

- Elevator Installation Cost Guide

- Stair Lift & Railing Cost Guide & Contractor Quotes

- Home Theater Installation Cost Guide

- Digital Phone System Cost Guide

- Above Ground Pool Installation Cost Guide

- Fiberglass Pools Cost Guide

- Garage Door Insulation Cost Guide

- Single-Hung vs. Double-Hung Windows Cost Guide

- Window Shutters Cost Guide

- Skylight Window Installation Cost Guide

- Landscape Lighting Cost Guide

- Window Blinds And Shades Cost Guide

- DIY Garage Lighting Installation Cost

- Wooden Garage Doors Cost Guide

- Sod VS Seed Cost Guide

- Artificial Grass Cost & Installation Guide

- Stump Grinder Rental Cost Guide

- Tongue and Groove Ceiling Cost Guide

- Wood Ceiling Cost Guide

- Washing Machine Repair Guide

- How To Get Rid Of Crickets: DIY Tips & Cost Guide

- Gnats Extermination Cost Guide

- Getting Rid Of Mice Cost Guide

- Getting Rid Of Carpenter Ants Cost Guide

- Termite Treatment Cost Guide

- Flies Extermination: DIY & Cost Guide

- Rats Extermination Cost Guide

- Roaches Extermination Cost guide

- Spiders Extermination: DIY & Contractor Cost Guide

- Silverfish Extermination: DIY & Cost Guide

- Get Rid of Moths: DIY & Cost Guide

- Getting Rid Of Springtail Bugs Tips & Guide

- How to Get Rid of Bees Guide

- Raccoons Extermination: DIY & Cost Guide

- How to Get Rid of Bats

- How to Get Rid of Dust Mites

- How to Get Rid of Carpet Beetles

- Squirrels & Chipmunks Removal Cost guide

- How to Get Rid Of Skunks

- How to Get Rid of Sugar Ants

- How to Get Rid of Stink Bugs

- Chain Link Fence Costs in 2024: A Comprehensive Guide

- Dog Fence Cost Guide

- How Much Does a Screened-In Porch Cost in 2024

- Sunroom Ideas & Cost Guide

- Outdoor Gazebo Cost Guide

- Patio Pavers Cost Guide

- Pea Gravel Cost Guide

- Disability Remodeling Cost Guide

- Composite Decking Cost Guide

- Heated Driveway Cost Guide

- Driveway Gates Cost Guide

- In-Ground Pool Cost Guide

- Fluorescent Light Fixtures Cost Guide

- Water Heater Repair: Installation and Cost Guide

- Indoor Air Quality Testing Guide

- Mold Testing & Inspection Cost Guide

- Asbestos Testing Cost Guide

- Baby Proofing Cost Guide

- Home Automation Cost Guide

- Home Staging Cost Guide

- Dustless Blasting Cost & Rental

- Wood Chipper Rental Cost Guide

- How To Clean A Mattress

- Chalk Paint Furniture Guide: How To, Cost & DIY Tips

- How to Use a Protractor

- How to Fix a Running Toilet? DIY Tips & Contractor Cost

- How to Unclog a Bathtub: DIY Tips & Contractor Cost

- How To Fix Cracks In Ceilings: Cost and DIY Guide

- How To Fix Squeaky Floors And Repair Scratches

- How To Unclog A Shower Drain: DIY Tips & Contractor Quotes

- How To Build A Treehouse: DIY Tips & Cost Guide

- How To Build A Greenhouse: DIY Tips & Contractor Cost Guide

- How To Build A Shed: Cost Guide & DIY Tips

- Easy Steps to Patch and Fix a Hole in the Wall

- How To Soundproof A Room: DIY Tips & Cost Guide

- How To Build A Pergola: Contractor Cost & DIY Tips

- How To Unclog A Toilet: DIY Tips & Cost Guide

- Room Divider Ideas: How To Make A DIY Room Divider?

- How To Clean Ovens: Efficiently And On A Budget

- How To Clean Stainless Steel: DIY Tips & Cost Of Materials

- How To Build A Deck: Cost To Build A Deck, Materials & DIY Tips

- How To Fix A Leaky Faucet: Tools & DIY Guide

- How To Build A Fire Pit: Cost Of Materials And Tips for DIYers

- Affordable DIY Headboard Ideas: Cost & Best Tips For Making One

- Clogged Sink? Practical Tips To Fix It Instantly!

- How To Remove Wallpaper: Tools, Materials & Costs

- How To Wire A Light Switch: Tips & Cost Estimate

- Thermostat Wiring For Dummies

- How To Clean Grout: An Easy DIY Guide

- Photo Transfer to Wood: DIY Tips & Tutorial

- How to Get Rid of Poison Ivy

- How to Stain Wood

- How to Stain a Deck

- How To Install Faux Wood Beams

- How To Wall Mount a TV

- How to Clean Cast Iron

- How to Paint a Ceiling

- Pocket Door Installation

- How to Lay Tiles

- How to Clean a Dryer Vent

- How to Lay a Carpet

- How to Remove a Stripped Screw

- Electrical Outlet Wiring

- How to Remove Paint from Wood

- General Contractors

- Handyman Services

- Home Builders

- Home Remodeling Contractors

- Painting Contractors

- Roofing Contractors

- Insulation Contractors

- Fence Companies

- Drywall Contractors

- Electrical Contractors

- Landscaping Contractors

- Tree Trimming Contractors

- HVAC Contractors

- Furnace Repair

- Home Decor Ideas & Decorators

- Solar Providers

- Construction Contractors

- Asphalt Contractors

- Laminating Contractors

- Plumbing Contractors

- Furniture Upholstery & Reupholstery Contractors

- Concrete Contractors

- Paving Contractors

- Animal & Pest Control Contractors

- Termite Inspection

- Carpet Cleaning Contractors

- Chimney Cleaning Contractors

- Refrigerator Repair

- Garage Door Repair

- Computer Repair

- Pool Repair

- Phone & Cell Phone Repair

- TV Repair

- Locksmith Services

- Window & Car Window Repair

- Lawn Mower Repair

- Tree Removal Services

- AC Repair & Car AC Repair

- Mold Removal Contractors

- Garbage Disposal Installation and Repair

- Kitchen Remodel

- Furniture Repair

- Kitchen Cabinets Refacing, Painting, And Design

- Laminate Services

- Appliance & Small Appliance Repair

- Carpentry Contractors

- Cabinet Makers

- Carpet Installation

- Mulch And Mulch Delivery

- Lawn Care Contractors

- Sprinkler Repair

- Christmas Lights Installation

- Bed Bug Exterminators

- Small Engine Repair

- Vacuum Repair

- Radiator Repair

- Gutter Installation & Repair

- Siding Contractors

- Excavating Contractors

- Snow Blower Repair Contractors

- Junk Removal Service

- Home Security Companies & Camera Installation

- Septic Tank Pumping

- Air Duct Cleaning

- Radiant Floor Heating

- Generator Repair

- Washer Repair

- Maid Service

- Deck Builders

- Architects

- Interior Designers

- Demolition Contractors

- Restoration Companies

- Real Estate Appraisers

- Machetes

- Shovels

- Pole Saws

- Tree Pruners

- Stump Grinders

- String Trimmers

- Pruning Shears

- Hedge Trimmers

- Electric Hedge Trimmers

- Riding Lawn Mowers

- Lawn Sweepers

- Snow Plows

- Leaf Rakes

- Log Splitters

- Tillers

- Leaf Mulchers

- Zero-Turn Mowers

- Self-Propelled Lawn Mowers

- Lawn Aerators

- Sprinkler Systems

- Garden Gnomes

- Indoor Plants

- Landscaping Rocks

- Patio Furniture Sets

- Wall Planters

- Garden Carts

- Lawn Fertilizers

- Loppers

- Wood Chippers

- Splitting Mauls

- Irrigation Systems

- Heated Dog Houses

- Lawn Rollers

- Electric Lawn Mowers

- Brush Cutters

- Rubber Boots

- Garden Spades

- Push Mowers

- Dog Kennels

- Post Hole Augers

- Wood Planers

- Miter Saws

- Chop Saws

- Reciprocating Saws

- Hammer Drills

- Right Angle Drills

- Belt Sanders

- Spindle Sanders

- Wood Jointers

- Rotary Tools

- Heat Guns

- Framing Nailers

- Rotary Hammers

- DeWALT Drills

- DeWalt Grinders

- Husqvarna Chainsaws

- Electric Chainsaws

- Cordless Sanders

- Screw Guns

- Concrete Saws

- Portable Band Saws

- Bosch Drills

- Oscillating Tools

- Circular Saws

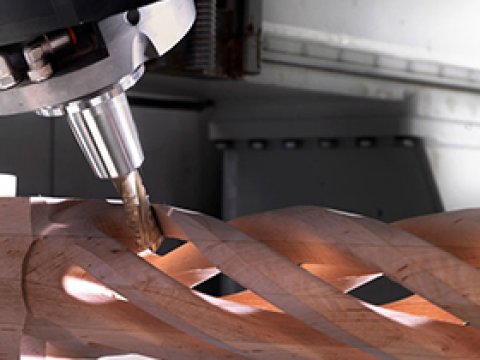

- Wood Router

- Cordless Drills

- Jigsaws

- Electric and Cordless Screwdrivers

- Angle Grinders

- Torque Wrenches

- Wrench Sets

- Cordless Impact Wrenches

- Lug Wrenches

- Ratchet Wrenches

- Cordless Impact Drivers

- Stud Finders

- Screwdriver Sets

- Staple Guns

- Electric Nail Guns

- Nailers

- Auto Feed Screwdrivers

- Caulking Guns

- Cold Saws

- Drywall Sanders

- Laminate Cutters

- Cable Cutters

- Band Saws

- Tile Saws

- Hacksaws

- Scroll Saws

- Carving Knives

- Coping Saws

- Multi-Tools

- Impact Driver Sets

- Nut Drivers

- Blacklights

- Chisel Sets

- Socket Sets

- Sledge Hammers

- Ball Peen Hammers

- Paint Spray Guns

- Torpedo Levels

- Grease Guns

- Breaker Bars

- Pipe Clamps

- Electrical Tapes

- Bolt Cutters

- Voltage Testers

- Laser Levels

- Pliers Sets

- Needle Nose Pliers

- Screw Extractors

- Crowbars

- Pocket Knives

- Soldering Guns

- Wire Crimpers

- Folding Knives

- Utility Knives

- Torx Screwdrivers

- Hex Keys

- Rivet Guns

- Fiskars Scissors

- Glue Guns

- Biscuit Joiners

- Micrometers

- Aviation Snips

- Tap and Die Set

- Paint Strippers

- Glass Cutters

- Wallpaper Steamers

- Crows Foot Wrenches

- Electric Planers

- Electric Hand Saws

- Keyhole Saws

- Locking Pliers

- Woodworking Hand Tools

- Safety Glasses

- Dust Masks

- Welding Helmets

- Ear Protectors

- Earmuffs

- Headlamps

- Wireless Home Security Systems

- Furnace Humidifiers

- Electric Heaters

- Multimeters

- Construction Calculators

- Flat Screen TVs

- LED Light Strips

- Halogen Bulbs

- Hygrometers

- Smart Light Bulbs

- Touch Lamps

- LED Light Bulbs

- Privacy Window Films

- Cell Phone Signal Boosters

- Motion Sensor Lights

- Patio Heaters

- Fire Pits

- Solar Battery Chargers

- Smart Outlets

- Smoke Detectors

- Video Doorbells

- Mini Refrigerators

- Garage Door Openers

- Anemometers

- Welding Glasses

- Motion Detectors

- Front Door Locks

- Gas Leak Detectors

- Oil Filled Heaters

- Jobsite Radios

- Drill Bits

- Router Bits

- Ladders

- Step Ladders

- Tool Chests

- Sawhorses

- Garage Floor Paints

- Tool Bags

- Knife Sharpeners

- Peel And Stick Tiles

- Interior Paints

- Paint Rollers

- Paint Brushes

- Laser Measure Devices

- Angle Finders

- Measuring Wheels

- Wall Stencils

- Kitchen Curtains and Drapes

- Socket Organizers

- Drill Bit Sharpeners

- Tool Vests

- Tool Belts

- Chainsaw Sharpeners

- Belt Pouches

- Bandsaw Blades

- Mechanic Tool Sets

- Surge Protectors

- Wood Glues

- Sanding Blocks

- Small Tool Boxes

- Chainsaw Oils

- Metal Tool Boxes

- Leaf Blowers

- Pressure Washers

- Floor Scrubbers

- Snow Blowers

- Snow Shovels

- Windshield Wipers

- Steam Mops

- Carpet Steam Cleaners

- Robot Vacuum Cleaners

- Closet Organizer Systems

- Bed Bug Sprays

- Window Cleaners

- Grout Cleaners

- Home Humidifiers

- Water Softeners

- Essential Oil Diffusers

- Portable Washers

- Storage Benches

- Robot Mops

- Stick Vacuums

- Handheld Vacuums

- Backpack Vacuums

- Shark Vacuums

- Drain Cleaners

- Rust Removers

- Hardwood Floor Cleaners

- Carpet Shampooers

- Cheap Carpet Cleaners

- Magnetic Sweepers

- Industrial Vacuums

- Car Vacuum Cleaners